VAT Making Tax Digital - MTD App for iPhone - Free Download VAT Making Tax Digital - MTD for iPad & iPhone at AppPure

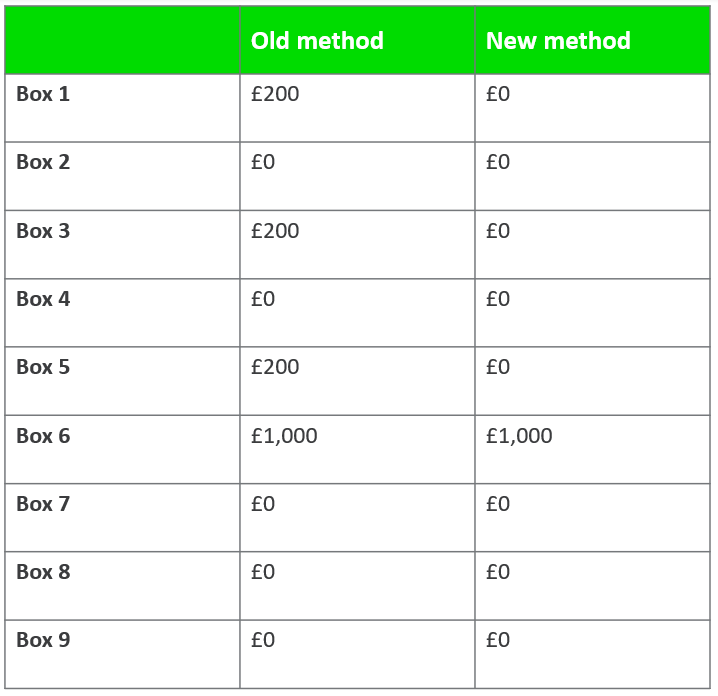

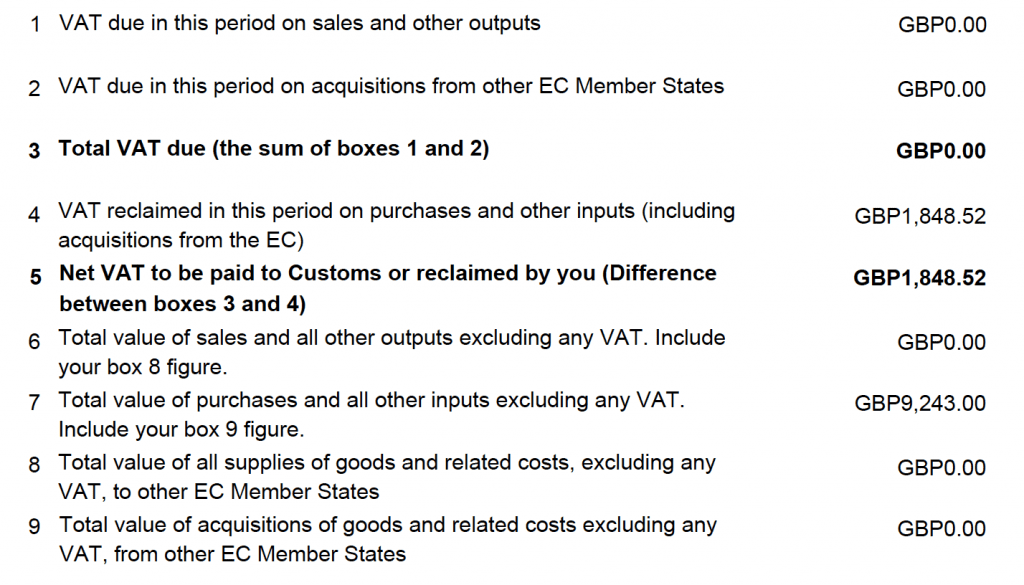

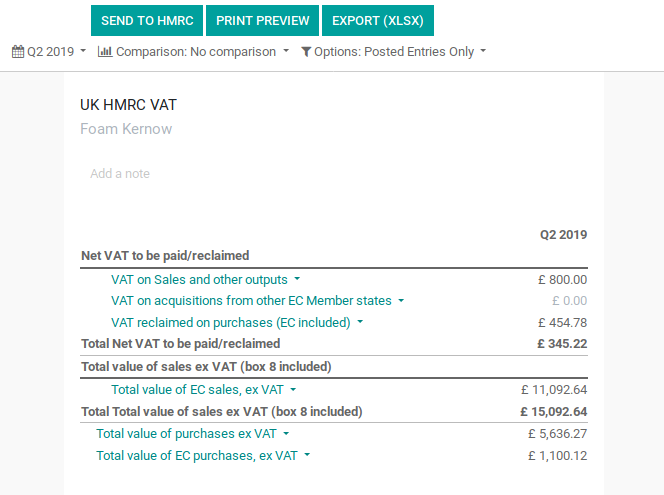

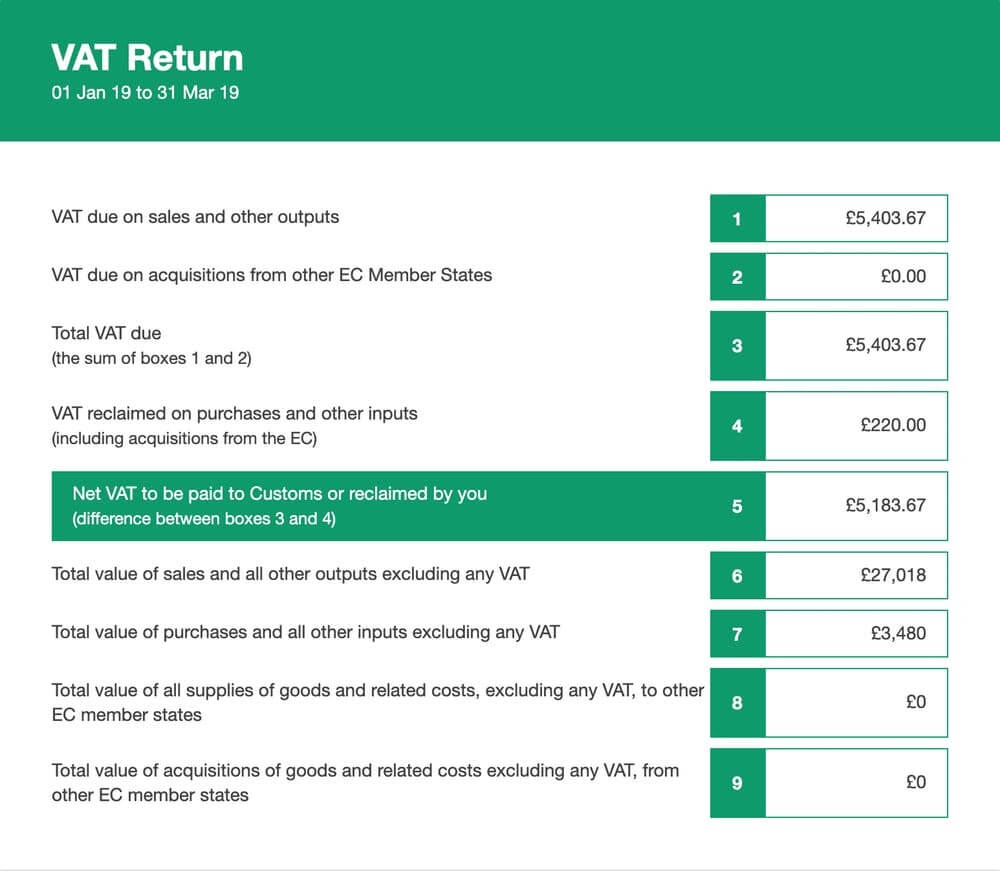

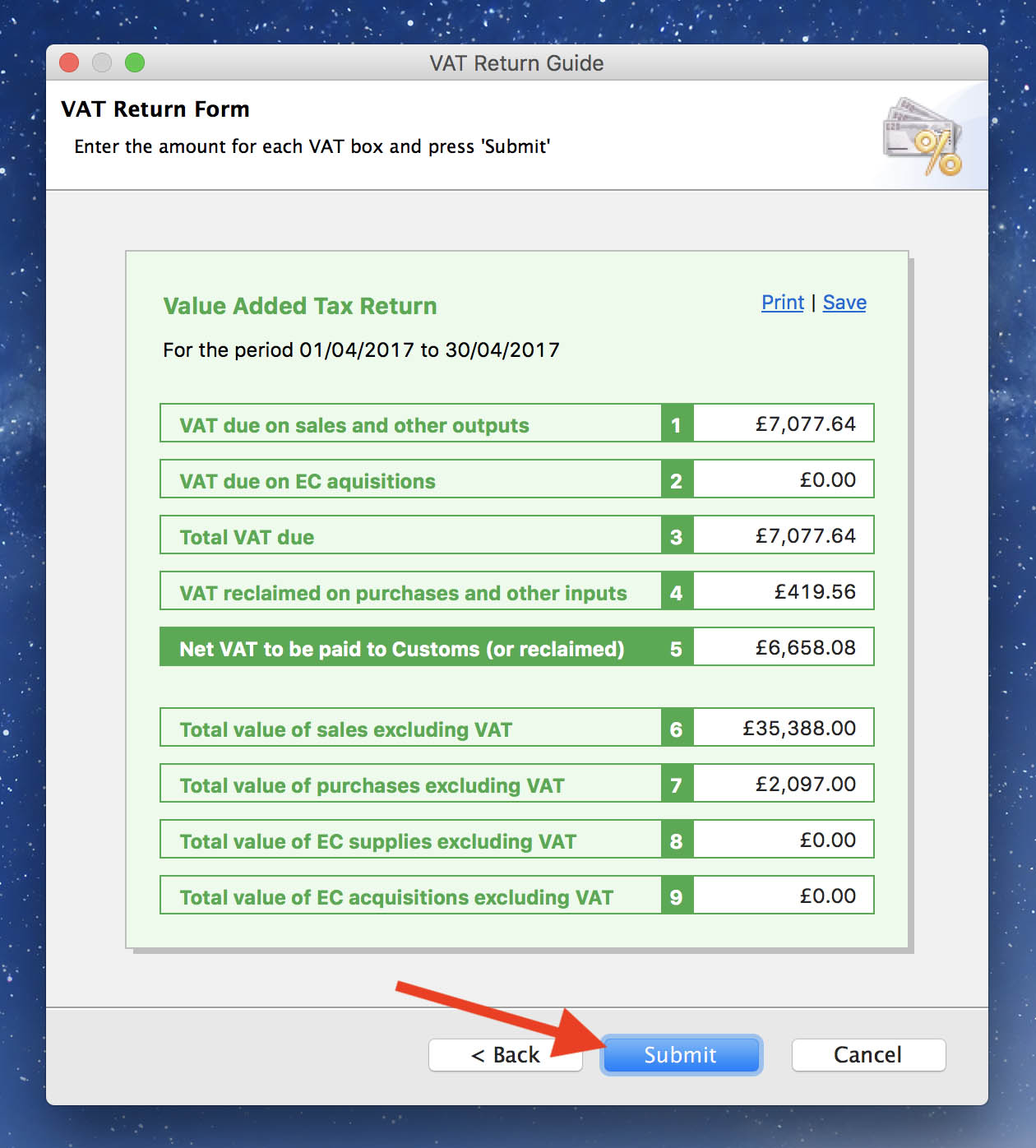

Product Updates 419, 418, and 417: VAT return reports with nil value supported for Making Tax Digital (MTD) functionality (UK legislation)